Pam

727-534-3445 | Tara 727-804-7144

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127

Need a Solution to Clearing Past Credit Problems That Can Result in a Mortgage Denial?

Do These Safeguards PRIOR to Giving a Mortgage Pre-Approval!

A growing number of clients have past credit issues that visibly don’t show up… but can still cause a new mortgage denial. What can mortgage loan originators (MLO) do? Be PRO-ACTIVE UPFRONT.

Run Loans Through the Fannie Mae Automated System (AUS) UPFRONT

During the past housing crisis, it was learned that past short sale credit was being erroneously coded as a foreclosure on credit reports [1].

This wasn’t visible on the credit report to loan originators, and the way that the problem was found was through the Fannie Mae AUS findings that would issue a Refer/Ineligible mortgage denial with a statement that there was a Foreclosure on the borrower’s credit.

Buried even deeper was the specific credit bureau (most often Experian) that triggered the Foreclosure indication… but this was only visible on the Meridian Link platform within a credit report.

So, what should a mortgage loan originator do when a client has a past short sale, foreclosure and even a bankruptcy in their past?

Specifically, run the loan through the Fannie Mae automated system (AUS) UPFRONT to insure getting an Approve/Eligible before giving a mortgage pre-approval. Fannie Mae findings will state what the specific problem is. Freddie Mac will not.

For information on how to correct erroneous credit in Calyx and Fannie Mae, go here.

Why is running a loan through the Fannie Mae AUS UPFRONT so important to do?

In most cases, affected past short sellers were told their loan received a denial AFTER the mortgage originator had told them they met the “wait time-frame” needed after a short sale, AFTER they had signed a home purchase contract and AFTER the homebuyer had spent hundreds of dollars on an appraisal and home inspection! The mortgage denial usually came from an underwriter who commonly runs the loan through the Fannie Mae and/or Freddie Mac automated systems towards the end of a contract period. In 2013 when a solution occurred within the Fannie Mae AUS, I intervened with hundreds of clients whose lenders were unaware of the Fannie Mae workaround. Often this was still too late in the process and many of these clients lost the contract they were in or settled for a higher interest non-QM loan with a greater down payment.

Other past credit issues that need to be checked on PRIOR to giving a mortgage Pre-Approval

- Veterans who had to deploy to another location and ended up having to short sale or go into foreclosure on their past home are surprised to find they have no eligibility on their VA Certificate of Eligibility (COE). For these clients, contact the VA for Bonus Entitlement and have your lender check CAIVR for clearance upfront.

- If a client had a prior bankruptcy and owned a property, and especially if that property went into foreclosure, retrieve a verification of mortgage (VOM) from the mortgage lender of that property to check the mortgage history for any late payment dates. Mortgage history does not show up on a credit report after a bankruptcy unless the mortgage is reaffirmed[2]. Don’t be caught off guard by late payments that can show up recently enough to result in a denied mortgage.

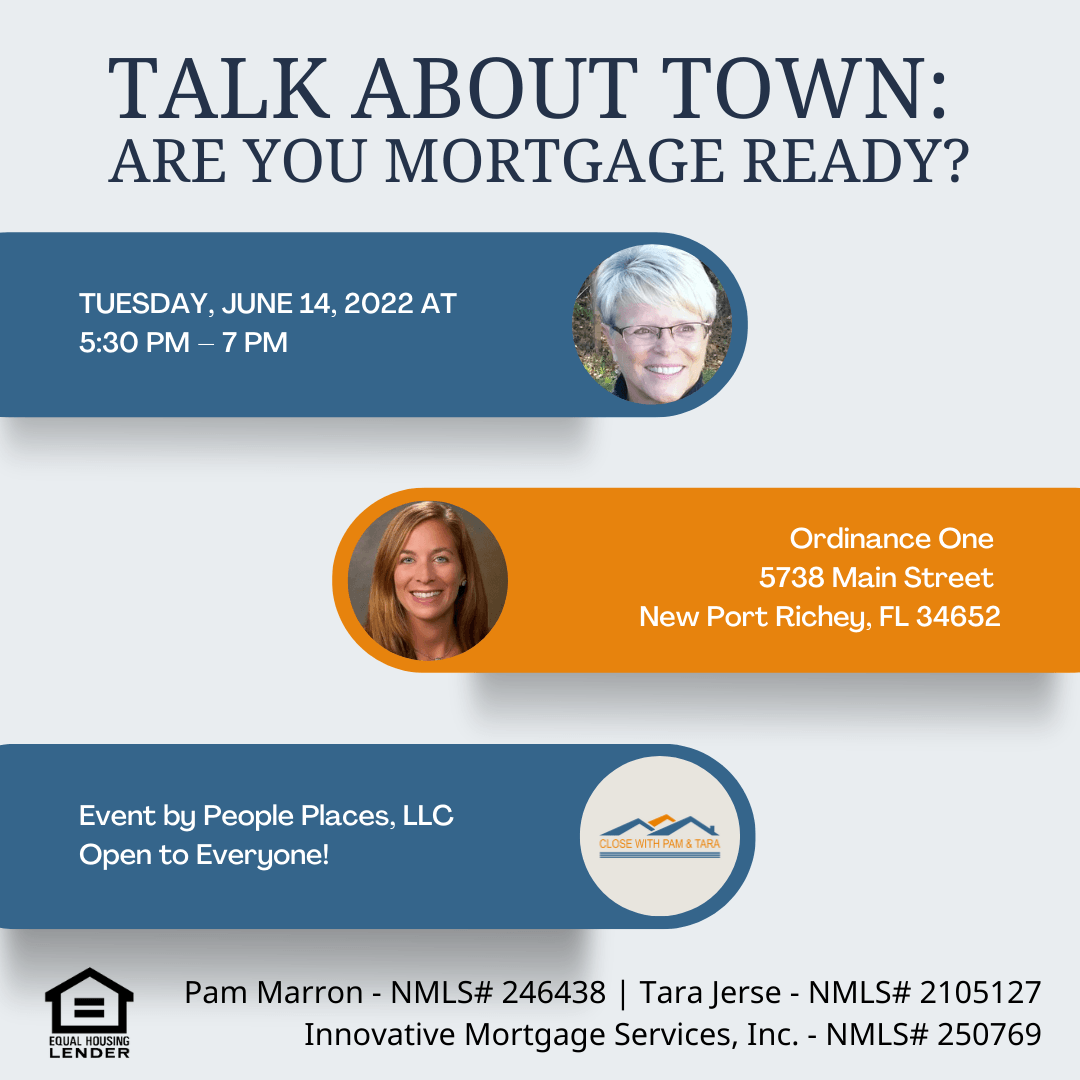

Help for Mortgage Loan Originators (MLO) to Connect Clients to Assistance for Credit Issues, Down Payment Assistance, Student Loan Refinancing and More is Coming

A handful of MLO’s have started working with HUD housing and credit counselors on a pilot program that matches clients with a need to counselors who can assist these clients to overcome issues and get “mortgage ready”. The pilot is leveraging IndiSoft’s National Housing Advocacy Platform (NHAPP), a cloud-based collaborative, seamlessly connecting MLOs, HUD-certified housing counselors and investors to support mortgage readiness counseling. Clients who need help will pay a “Fee for Service” upfront to HUD counselors and be referred by their MLO with a Memorandum of Understanding (MOU) that promises a credit back to the clients’ mortgage closing costs if they return to that MLO for their home mortgage. Fine tuning of seven services and costs that HUD counselors can provide is currently being assessed. Who and when safeguards discussed in this article are applied are being considered as well.

DO SAFEGUARDS UPFRONT!

This I know. There were solutions that resulted from problems that arose out of the housing crisis. Those solutions are still valid, and most are simple to do. The key is to apply safeguards upfront.

Probe deeper with clients who have had issues in the past and pro-actively check to make sure those issues don’t stall any of your clients from becoming a new homeowner. If you don’t know how to run clients through Fannie Mae and Freddie Mac automated systems, LEARN IT NOW, or find out how your lender can do this upfront. Find out who can pull CAIVR at your lender, call VA yourself on COE Bonus Entitlement and order needed VOM’s before your client spends any money. As mortgage professionals, we owe this to our clients.

Stay tuned. Coming up… bigger, better affordable housing mortgages.

What do you need help with? Contact us Today!

Pam Marron | NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc. | NMLS# 250769

Equal Housing Lender

Close With Pam & Tara!

Helping clients, realtors, and loan originators get "mortgage ready" for over 36 years!

Pam Marron

| NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc.

| NMLS# 250769

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127 Innovative Mortgage Services, Inc. NMLS #250769 - NMLS Consumer Access / Legal Disclaimer - This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. All Zillow rate data and Zillow reviews are © of Zillow, Inc. 2006-2021.