Pam

727-534-3445 | Tara 727-804-7144

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127

Down Payment Connect is a Game Changer for Mortgage Loan Originators

Mortgage Loan Originators, Realtors and HUD Housing Counselors Who Need to Find and Promote Down Payment Assistance (DPA) to Clients Need this Tool!

Downpaymentresource.com is a free public-facing website that offers prospective home buyers the ability to find down payment assistance programs they may qualify for. But did you know that there is a back-end tool called Down Payment Connect that mortgage loan originators (MLO), Realtors and HUD housing counseling agencies (HCA) can use to find nearly all down payment assistance (DPA) programs in the United States?

There is a monthly fee for this tool, but having this comprehensive, up-to-date information about each DPA program in the same place with filters now available to drill down precisely for client and property criteria has just made getting DPA easier for prospective buyers!

MLOs often share a reluctance to dive into DPA products citing bad experiences they’ve had in the past. Others feel matching the 1st mortgage criteria with the DPA criteria is too cumbersome. But the growing need for down payment assistance has moved to the top of the list of what clients need to purchase a home. Let’s get right into how this invaluable tool can help!

MLO Promoted as DPA Originator

Mortgage loan originators (and Realtors) that sign up as a subscriber receive a landing page through Down Payment Connect that can be linked to your personal website. On this landing page, a subscriber MLO can select the DPA programs they can originate and only those programs show up to potential clients. Marketing resources including social media, live and recorded webinars, articles about DPA to post, videos and even reporting that shows how many visitors have visited your landing page are all provided.

Highlights In DPA Directory

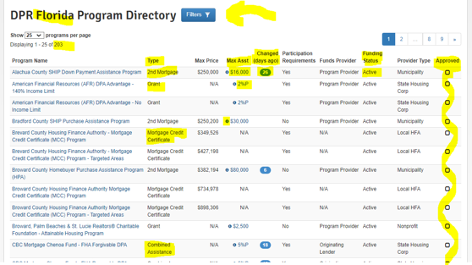

The most important tool in Down Payment Connect (to me) is within the DPA Directory located on one of the eight buttons subscribers see once logged in. This button opens to your selected DPR (state) Program Directory (shown below) that houses hundreds of DPA programs and provides a consistent overview of each program page in the same order.

On the DPR (state) Program Directory:

- Type lets you know if the DPA is a 2nd mortgage*, Grant**, Mortgage Credit Certificate (MCC) or Combined Assistance***.

* 2nd mortgage and Grant are what MLO’s can commonly add to 1st mortgages you are already originating. **A Grant is treated like a gift. ***Lender provides and underwrites both 1st and 2nd DPA mortgage.

- Max Asst shows max dollar or percentage amount client can receive.

- Changed (days ago) alerts you how long ago a recent update to a program occurred.

- Funding Status shows if a program is Active, Suspended or Inactive.

- The Approved column allows an MLO to select the programs they want visible to prospective clients.

What Each DPA Program Page Contains

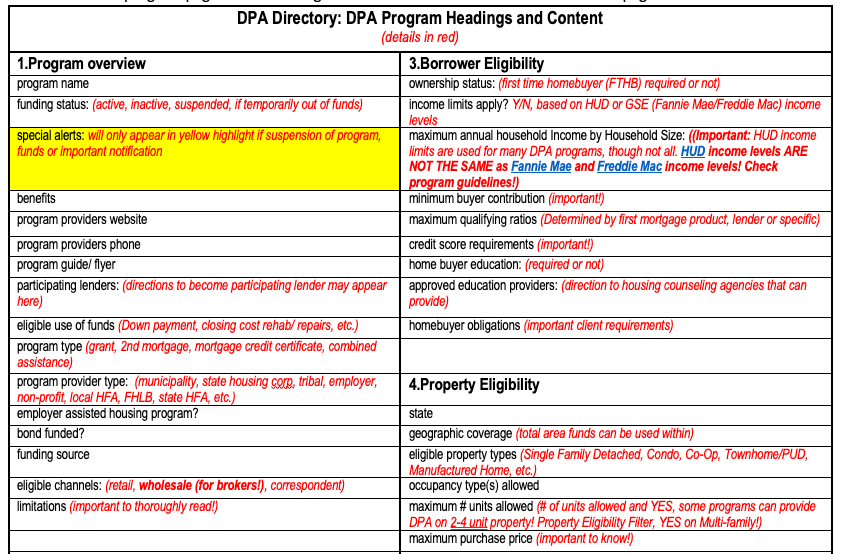

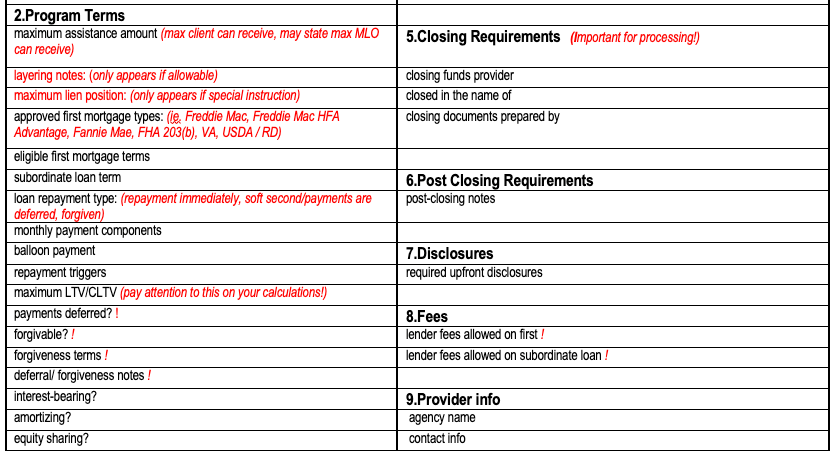

Within each DPA program page are 10 headings of “need to know” information and all DPA pages are in the same order.

Here are a few “need to know” details.

Program Overview:

- Participating Lenders commonly provide direction to get approved for DPA.

- Eligible Use of Funds can let you know if rehab/repairs may be an acceptable use of funds.

- Program Overview has added Wholesale programs available to independent mortgage loan originators/brokers on Eligible Channels!

Program Terms:

- Approved 1st mortgage types show your 1st mortgage type that DPA program can be subordinated to.

- On all programs, check under Program Terms for deferral, forgiveness and criteria that must be met for forgiveness.

Borrower Eligibility:

the most important heading for MLO’s and HUD housing counselors! Here’s where you find:

- Maximum (combined) Qualifying Ratios

- minimum Credit Scores

- if Home Buyer Education is required and where clients can go to get needed education. HUD housing counseling agencies may even want to use this knowledge to investigate more avenues of housing education to facilitate.

- Income limits apply?: yes or no, and if income is based on HUD or GSE (Fannie Mae/Freddie Mac) income levels.

- Maximum annual household Income by household size: many DPA program are based on HUD Area Median Income (AMI) levels that are derived from the total household family size and the total income of all household members over the age of 18.

- HUD income levels ARE NOT the same as Fannie Mae and Freddie Mac income levels! Which income to use (HUD or GSE/Fannie Mae or Freddie Mac) is noted in Income limits apply?, and income max is commonly listed in Maximum annual household Income by household size.

- This difference can be seen in DPA programs that are specific to Fannie Mae and Freddie Mac. Income limits apply? May state Income limits from FHFA/GSE 2022 80% AMI guidelines or tell you to check with lender.

Some DPA programs have a maximum dollar amount of assets (commonly $20,000) that a client can have to be eligible for DPA. This will be found under Borrower Eligibility in Maximum Assets Allowed if this field is shown. Check with DPA programs for this detail.

Property Eligibility:

- Eligible property types shows if manufactured homes are allowed, which can also be found using filters: Property Eligibility>Eligible Property Types>Manufactured Homes.

- Maximum #units allowed shows up to 4 if multi-family allowed. Also use filter: Property Eligibility, select Yes under multi-family.

Yes, there is DPA listed for… Use Filters! (Also, click on small i in blue circle for more information.)

- For licensed mortgage loan originators/brokers to specifically find Wholesale lenders, click on Product/Program Overview>Eligible Channels and select Wholesale from Retail, Wholesale, and Correspondent in the dropdown.

- No income levels! Click on Income Limits> Limits Apply?> No: Only show programs that do not have limits on borrower income.

- Multi-family properties! Click on Property Eligibility>Multi-Family>Yes: Only show programs available for multi-family (2-4 unit) properties.

- Deferred and Forgivable DPA: Click on Product/Program Terms and pick yes or no under the Deferred Payments and Forgivable tabs.

- First-time homebuyer (FTHB) or not, is found under Borrower Eligibility.

The information provided in this article is tip of the iceberg!

Once you open Down Payment Connect, you will use it daily! MLO’s are getting emails about new DPA programs that lenders are providing more often, and DownPaymentResource.com continues to add these programs and improve originator, Realtor, HUD housing counselor, and client awareness of all down payment assistance nationally. MLO’s, to subscribe and get access to all things DPA to assist more clients, you need Down Payment Connect!

Stay tuned.

What do you need help with? Contact us Today!

Pam Marron | NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc. | NMLS# 250769

Equal Housing Lender

Close With Pam & Tara!

Helping clients, realtors, and loan originators get "mortgage ready" for over 36 years!

Pam Marron

| NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc.

| NMLS# 250769

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127 Innovative Mortgage Services, Inc. NMLS #250769 - NMLS Consumer Access / Legal Disclaimer - This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. All Zillow rate data and Zillow reviews are © of Zillow, Inc. 2006-2021.