Pam

727-534-3445 | Tara 727-804-7144

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127

Getting Clients Mortgage Ready

Whether you are a client who needs assistance or a realtor or loan originator who needs help for your client, help is available!

Pilot Program Started to Connect Independent Loan Originators to Housing Counselors to Get Clients in Need of Assistance “Mortgage Ready”

In June 2016 after being appointed by (then) U.S. HUD Secretary Julian Castro to be on the HUD Housing Counseling Federal Advisory Committee (HCFAC), I learned how much pre-purchase work housing counselors provide to clients who aren’t quite ready to purchase a home yet.

Housing counselors already work with bank loan originators and their services are often funded by Community Reinvestment Act (CRA) funds provided by banking institutions. But independent mortgage loan originators don’t have CRA funds.

What if trained housing counselors could provide needed assistance for clients of independent loan originators… and those loan originators could offer an incentive towards mortgage closing costs for their clients who engaged with housing counselors to prepare for homeownership?

Out of this came a grass root pilot program that connects independent loan originators and realtors to HUD approved housing counselors for specific help for clients that includes in-depth help with credit issues and building credit, assessment for down payment assistance programs and budgeting for a home.

A way that clients in need can get help from housing counselors and get a credit from a referring loan originator towards their mortgage closing costs was developed to encourage independent loan originators to utilize housing counselors for their clients.

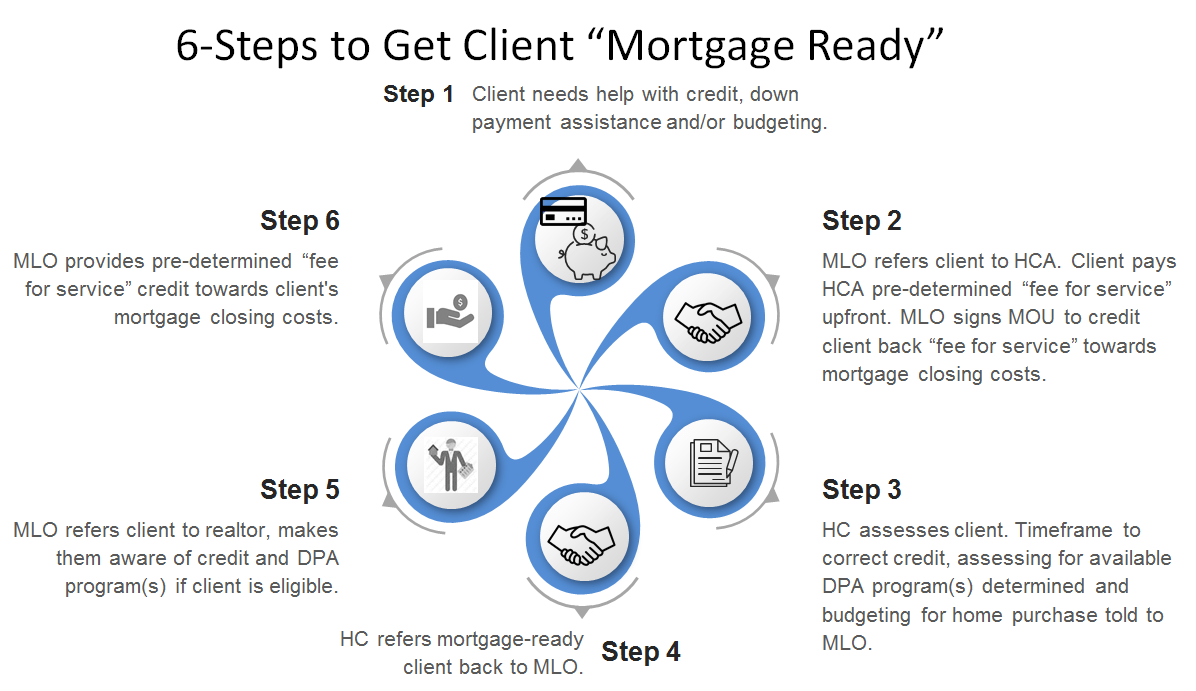

How Mortgage Ready Works

- A client comes to an independent loan originator or is referred by a realtor to an independent loan originator. The client is determined to need assistance with 1, 2 or all of the services noted below:

- in-depth credit help or building credit. Credit correction with the client’s involvement, rather than credit repair with disputes that simply hide credit issues.

- down payment assistance (DPA) assessment: county, city, state and wholesaler DPA programs

- budgeting for a home

- The client pays a set fee upfront for specific housing counseling services. Currently this cost is $275 plus credit report. The referring loan originator signs a Memorandum of Understanding (MOU) and agrees to provide a credit for housing counseling services paid upfront towards the client’s closing costs if the client returns to the loan originator for a mortgage.

- The housing counselor assesses the client for needed assistance and determines what time frame it will take to get the client ready for a mortgage. The housing counseling agency will not only assess the client for state, city and local SHIP DPA programs but will also assess for wholesaler DPA programs that independent loan originators are able to utilize!

- When the client is “mortgage ready”, the housing counselor notifies the independent loan originator. The client can go to another lender for their mortgage but the credit towards closing costs promised through the MOU will only be provided by the referring loan originator through that loan originators mortgage company.

- The loan originator refers the client back to the initial referring realtor or a new realtor and informs the realtor of any DPA programs to be used.

- Per the initial MOU, a credit for the pre-determined dollar amount of housing counseling fees is provided on the clients Loan Estimate and Closing Disclosure. The Closing Disclosure is provided to the housing counseling agency to insure credits provided under the initial MOU are provided to the client.

What Mortgage Ready Looks Like

Benefits of Pilot Program

- This process provides a funding alternative for client housing counseling to loan originators that change employment from a bank that pays for housing counseling services through CRA funds to working as an independent loan originator with a mortgage company. Loan originators are able to utilize housing counseling services with continuity whether they work for a bank or for a mortgage company.

- This pilot program provides trained HUD housing professionals to assist clients with issues that are preventing the client from gaining homeownership. Loan originators have varying levels of success with helping clients and detailed client needs can tend to take longer when loan originator business picks up. HUD housing counselors concentrate on getting clients ready for a mortgage.

- This option provides an avenue for ALL clients who want to purchase a home but aren’t in a position to do so yet! The playing field is leveled… determined clients pay for services upfront with an MOU that promises a credit for the upfront cost when the work is done and the client closes on a home!

- This method provides introduction of above low to moderate income (LMI) clients to housing counselors who can provide assistance with no income maximum requirement!

- Realtors become more aware of how housing counselors can help their clients… when they get the home purchase referral back when the client is “mortgage ready”!

- Housing counseling provides assistance with credit correction by working with the client to correct issues once and for all. Housing counseling agencies used in this pilot program have in-depth credit training and should not be considered a credit repair company.

Close With Pam & Tara!

Helping clients, realtors, and loan originators get "mortgage ready" for over 36 years!

Pam Marron

| NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc.

| NMLS# 250769

Pam Marron NMLS# 246438 Tara Jerse NMLS# 2105127 Innovative Mortgage Services, Inc. NMLS #250769 - NMLS Consumer Access / Legal Disclaimer - This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. All Zillow rate data and Zillow reviews are © of Zillow, Inc. 2006-2021.